COVID-19 and Market History.

We are several weeks into the COVID-19 (coronavirus) pandemic. The stock market has been is near free-fall as confusion, panic, and dare say hysteria grip the public. We don’t know how or when this crisis will reach the end of its course.

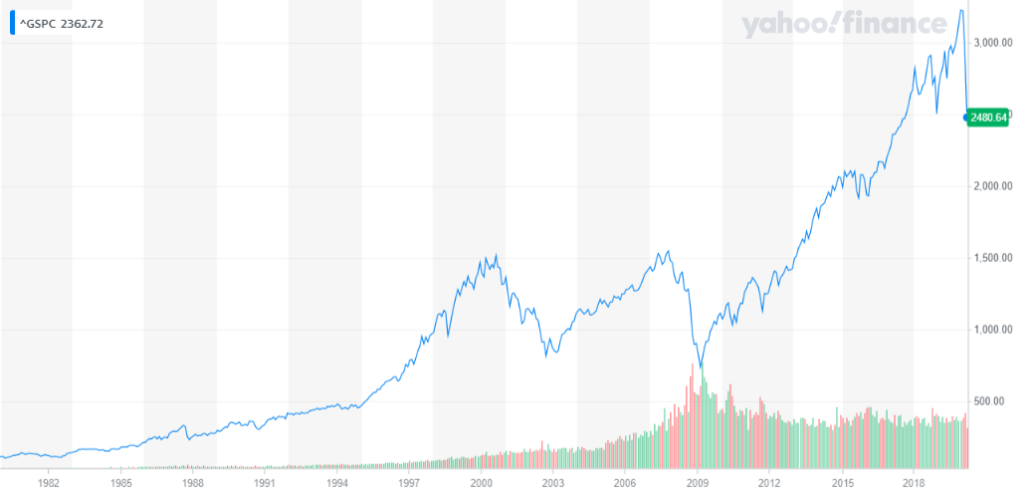

The graph below shows the performance of the S&P 500 from January 1980 to March 2020. This period included the 1987 market crash, two gulf wars, the dot-com bubble, and the financial crisis of 2008-2009. The various down periods caused serious concern and even panic. But notice that regardless of the cause of each downturn, and the market hysteria that ensued, the market always – always – recovered.

Successful investing requires patience and discipline. Patience is the understanding that wealth is built over the long term and the ability to follow a long-term plan through short-term crises to achieving a long term goal.

Discipline is the ability to stick to your investment plan regardless of what the market, talking heads, or the investment herd is doing at any given moment. While others are losing their heads, the important thing is to keep yours. Even though the urge to “SELL!!!!” may be overwhelming, not reacting and maintaining a cool head will reward you in the long run.

It has been over 10 years since the last bear market (defined as a market-wide decline of stock prices of at least 20%) of 2008-2009. We were actually long overdue for one. While the cause of this crisis is different from previous ones, the eventual outcome will be the same. The market decline will stop, the market will reorient and once again resume its inevitable upward climb to recovery and beyond.

The time-tested advice during volatile times is to not time the market (get out and get back in). Doing so risks missing the strongest points of a recovery. By the time someone reacts to “stabilizing” evidence, she most likely missed the best opportunity for recovery.

We don’t know how far the market will drop, when the market will start to recover, or how long it will take to reach pre-crisis levels. But know one thing – it will.